|

|

|

Distinguished Toastmaster

BUSINESS & BRANDING COACH . LIFE & LEADERSHIP STRATEGIST MOTIVATIONAL SPEAKER SERVING ENTREPRENEURS & MAIN STREET |

SEC & INTELLECTUAL PROPERTY [ You Are At This CLICK ]

INDEX

- FINRA FORCED ARBITRATION OF INVESTMENT CLIENTS IS A VIOLATION OF THE 10TH AMENDMENT OF THE CONSTITUTION RATIFIED 1791 (c) Carrie Devorah

Forced FINRA Arbitration Is Unconstitutional (c) Carrie Devorah

COMMENT: SEC PROXY VOTING ROUNDTABLE (c) Carrie Devorah

CONGRESS APPROVING WALL STREET DERIVATIVES FORECASTS ANOTHER CRASH & A VIRTUAL ROBBERY A’ COMING (c) Carrie Devorah

CONGRESS IS CULPABLE FOR THE CRIME AGAINST BARBARA ANN FINN (c) Carrie Devorah

BLAME FINRA FOR ERIC GARDNER's DEATH (c) Carrie Devorah

- BLAME FINRA FOR FERGUSON (c) Carrie Devorah

FINRA Requests Comment on a Revised Proposal to Adopt Consolidated FINRA Rule 2231 (Customer Account Statements) (c) Carrie Devorah

COMMENT: SEC File Number S7-07-11 (c) Carrie Devorah

COMMENT: FINRA Form 211 (c) Carrie Devorah - COMMENT ON FINRA's Rules 2210 & 2214 (c) Carrie Devorah

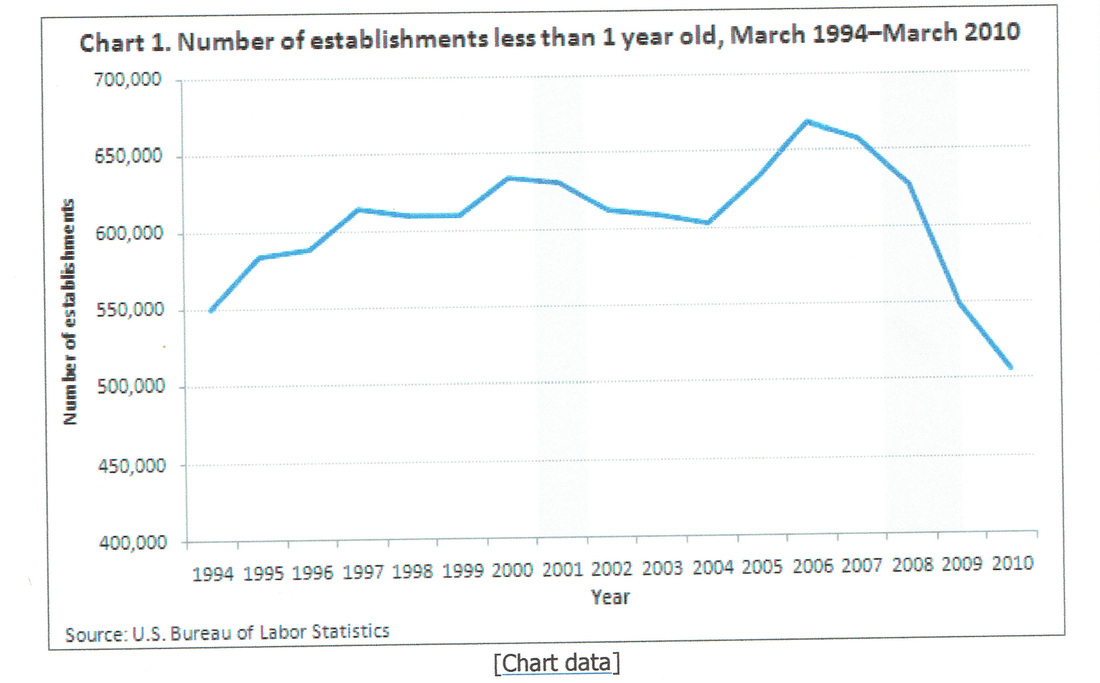

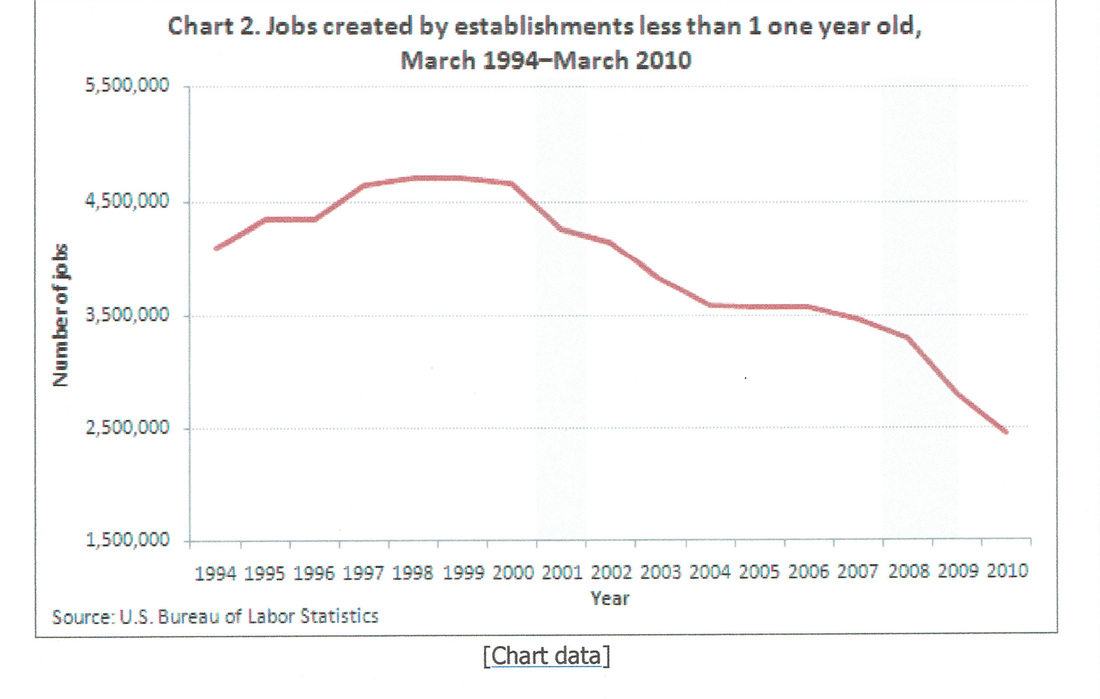

COMMENT: FINRA's GOT SOME 'SPLAININ' TO DO (c) Carrie Devorah - COMMENT ON SEC PROPOSAL FOR JOBS Jumpstart Our Business Startups (c) Carrie Devorah