|

|

|

Distinguished Toastmaster

BUSINESS & BRANDING COACH . LIFE & LEADERSHIP STRATEGIST MOTIVATIONAL SPEAKER SERVING ENTREPRENEURS & MAIN STREET |

__________________________________________________________________________________________________________________

CONGRESS CREATED MADOFF (c) Carrie Devorah:

__________________________________________________________________________________________________________________

CONGRESS CREATED MADOFF (c) Carrie Devorah:

__________________________________________________________________________________________________________________

On the eve of the 5th anniversary of DODD FRANK, Congress needs to go dark, go silent, do nothing, no lobbying, no fundraising. Read. Dont rely on staffers. Pull an all nighter, no mics, nothing. Read below. And then read backwards as far as the Buttonwood Tree to understand how in fact Congress pulled a "Hitler", deciding who will not be punished for stealing others entrusted life savings stolen by invoking AWC's, acceptance, waivers and consents along with "without admitting or consenting" while others die alive in jail for lesser crimes that harmed themselves and/or possibly others.

Congress created Madoff. Congress wrote the rules. And then wrote more rules, and more and more. And "Orange is Wall Street SRO's New Black."

Congress needs to tear the rules down to ground zero and start all over, that is, if both sides of the aisle truly care about Main Street. Otherwise, Congress is compounding more Madoff's license to steal.

DODD FRANK says no account can be opened without the person present, that post office boxes are not allowed as addresses and that ID such as a passport and/or drivers license must be presented.

What if I can show you that a major wall street brokerage and bank did not follow those requirements.

SARBANES OXLEY says the Respondeat Superior is liable for jail if the rules of SOX are not followed. What if I can show you SOX rules are not followed?

Lawyers get in the way forgetting that they answer to an ethics. The lawyers ethics are administered by S.R.O's, the wagon the circle to protect their own kinda' guys. One is presuming the lawyer knows their craft, throughly investigated papers, went through discovery or is that kinda guy that bails at the first opportunity for settlement, the kinda guy or gal that jumps in, jumps on, then is off to 'next.' Mothers warn daughters about men like that. Clients assume that a law degree sanctions honesty. Clients find out too late, after, being dragged in to the SRO forum.

Can't only blame the lawyers. Each Bar and Ethics Committee interviewed stated they do not require lawyers to write Bar numbers on business cards, in emails and on papers submitted to the Court. The Bar number should be. After all, there is a reason Bar and Ethics Committees have rules lawyers are held accountable to. Shame, few read them as written, rather than seeking loopholes to argue on.

Amazing how few legislators actually understand how the forum works. That the SRO holds arbitrations compliant with the FAA, Federal Arbitration Act. That Act is for maritime issues. Consumer arbitrations are to be compliant with the UCC, universal commercial code. Lest we forget, arbitrations are to be conducted by a neutral 3rd party. The SRO that admittedly conducts almost 99% of the Wall Street-Main Street disputes is a business league that Wall Street pays dues to. Accepting dues from Wall Street, disqualifies the SRO from accepting Main Street complaints.

Amazing how no one has copped to that before now.

Amazing how no one has talked about Madoff and his crimes, pre-2009. Not the US Attorneys that Congress said has oversight of Wall Street crimes. Least of all the SRO, FINRA, that has oversight of Madoff. Hmmm, scratch that. Make that a maybe. By holding the corporate persona of both a Brokerage and Investment Advisor, firms were able to pull complaints in to the SRO DRS, with the client being none the wise.

Dont even get started on the suckabees that feed off investor pain, the lawyers. Amazing how books are written by former US attorneys, city defenders etc that state that they can argue SRO cases in states they are not licensed in. Cant complain. They either threaten to sue the client already traumatized by the Wall Street insider and by the SRO process. The states are of no help. The state Bars dont have their act together on this one either. Random poll to pull- ask how many ever even heard of the SRO holding DRS in their city. AND then ask what happens if that foreign stated lawyer is reported to that Bar of the City the DRS was held in.

Nothing happens. That Bar will tell the person that local Bar does not have oversight over lawyers not licensed by them EVEN if that foreign state lawyer is technically practicing law without a license, in that local city. Dare not tell that foreign lawyer's Bar association in that discretion of what is confidential, protecting the complainant, changes depending upon who does phone intake and who does the letter intake. The complained about lawyer then, can/will, make a call to someone who makes a call, cagey to keep contact distant and not in writing. There is always a paper trail that can be built. But why would a client complain, even in the case of the customer whose representing counsel cashed the DRS refund check for an arbitration or mediation that may have settled.

The judge themselves admit to being overwhelmed and under educated as to the specificities of documents put before them. Judges look at case law and case precedence. Unfortunately, this a a bugaboo in the realm of Wall Street v Main Street. There is Federal law case precedence of cases like Madoff who turned himself in. Federal decisions are Counts for each crime committed. This Federal application may not necessarily have the local law component and for the time period in question another problem for law enforcement looking to do what they do best, protect the beats they walk from the Beasts Of Wall Street that prey.

So below it is shown that Bernard Madoff told the truth, that "THEY KNEW." "They" did. 50 years ago "THEY KNEW" that Madoff was selling no product. But Congress wrote the rules that led Madoff continue to rob investment clients for 5+ decades along with the rules that put Eric Garner behind bars 11 times.

What to do? Well, the law does accommodate for that on local, state and Federal platforms- accessory to crimes, before, during and after the fact. Judges, lawyers, regulators and SROs are not above the law, a gift to maybe every trusting investment client led in to a FINRA forum that worked out badly for the investor. Congress wrote the law that says the SRO is advocating in issues of Broker and Brokerage. Broker and Brokerage. Broker and Brokerage.

The Investment Act of 1935 is very clear 'what to do' when the rules Congress wrote for the SEC, Securities and Exchange Commission, to follow are violated. Madoff was to be reported to the US Attorneys FIFTY YEARS AGO. No one told the US Attorneys. No understanding why Madoff was not to be reported to local police. Ahhh, yes. Corrected, someone did tell the US Attorneys. Madoff did, himself. A few months after the SRO that the SEC appointed sanctioned Madoff for $25,000.

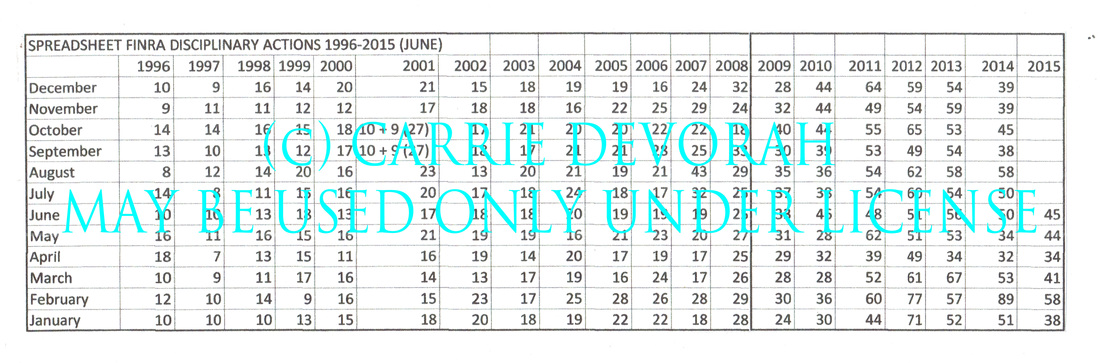

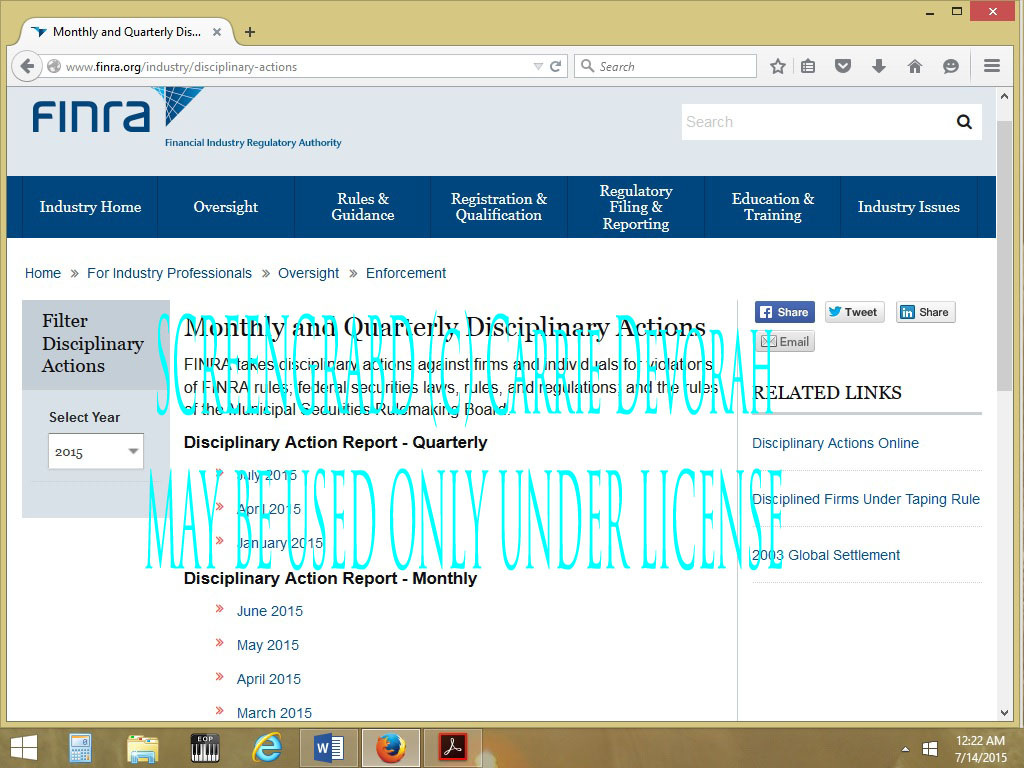

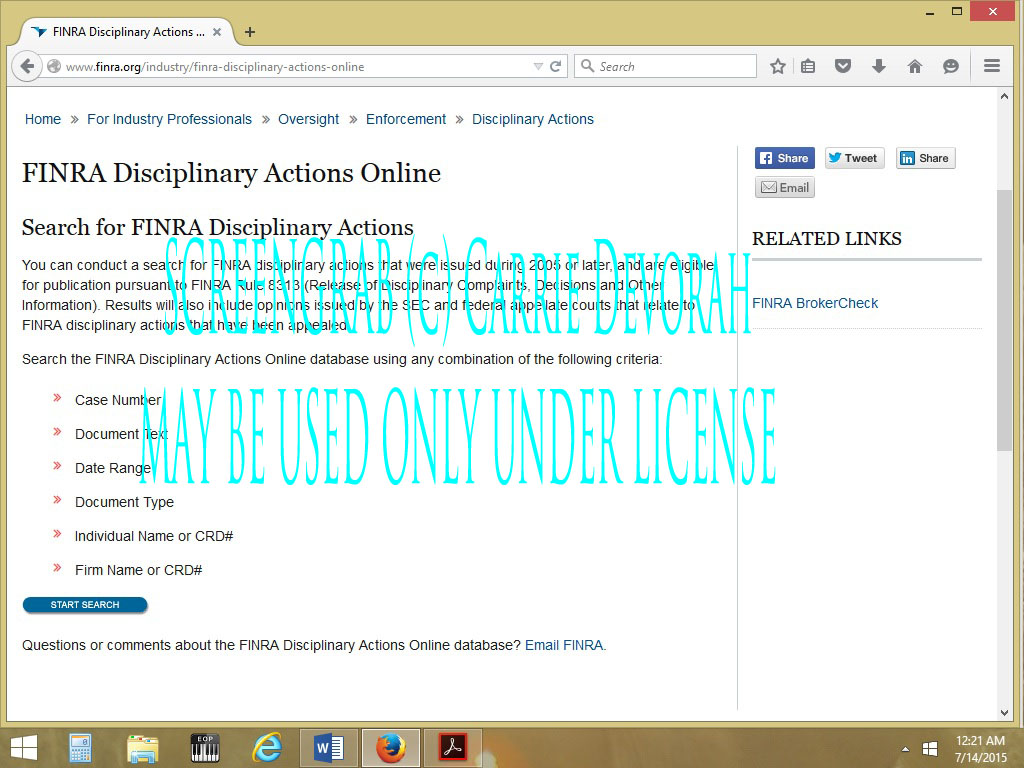

The SRO, Self Regulatory organization came intervened to keep the investment client complaints away from law enforcement, bringing the complaint Sanctions against Madoff's firm, not against Bernie and Peter, who owned the firm, as screengrabbed below. No need to report a complaint if the cops didn't press charges. No charges to press if no one signs a complaint, having been deterred to FINRA Dispute Resolution where confidentiality agreements are signed when a complaint is brought in and expungement agreements are signed if a client wants to collect an award if an award is determined.

The SRO wrote, "... you seem to think that FINRA’s By-Law, Article VI, Section 3, exempts you from any legal obligation to pay the arbitration award at issue because it contain an exception for “valid basis for non-payment.” The By-Law in question permits FINRA to suspend the licenses of firms and associated persons who fail to pay an arbitration award, unless they present a valid reason for not paying the award. The By-Law does not apply to you because you are not a firm or associated person subject to FINRA’s regulatory jurisdiction. You do not hold a securities license that FINRA could suspend."

Dispute resolutions are supposed to be neutral with the law applied equally. With all of the speculation over the years, by investment clients, there is no more quesswork. The SRO arbitrations and mediations are not just. Decisions rendered by the SRO should be repealed, no less, than as far back as 2007 when it underwent its name change from NYSE & NASD to FINRA. Congress let this fraud happen with rules Congress wrote, rewrote time and again.

Eric Garner was not given a chance to give a "valid reason." Garner was jailed, 11 times, over. President Obama's commutants were incarcerated.

Congress created Madoff. Congress wrote the rules. And then wrote more rules, and more and more. And "Orange is Wall Street SRO's New Black."

Congress needs to tear the rules down to ground zero and start all over, that is, if both sides of the aisle truly care about Main Street. Otherwise, Congress is compounding more Madoff's license to steal.

DODD FRANK says no account can be opened without the person present, that post office boxes are not allowed as addresses and that ID such as a passport and/or drivers license must be presented.

What if I can show you that a major wall street brokerage and bank did not follow those requirements.

SARBANES OXLEY says the Respondeat Superior is liable for jail if the rules of SOX are not followed. What if I can show you SOX rules are not followed?

Lawyers get in the way forgetting that they answer to an ethics. The lawyers ethics are administered by S.R.O's, the wagon the circle to protect their own kinda' guys. One is presuming the lawyer knows their craft, throughly investigated papers, went through discovery or is that kinda guy that bails at the first opportunity for settlement, the kinda guy or gal that jumps in, jumps on, then is off to 'next.' Mothers warn daughters about men like that. Clients assume that a law degree sanctions honesty. Clients find out too late, after, being dragged in to the SRO forum.

Can't only blame the lawyers. Each Bar and Ethics Committee interviewed stated they do not require lawyers to write Bar numbers on business cards, in emails and on papers submitted to the Court. The Bar number should be. After all, there is a reason Bar and Ethics Committees have rules lawyers are held accountable to. Shame, few read them as written, rather than seeking loopholes to argue on.

Amazing how few legislators actually understand how the forum works. That the SRO holds arbitrations compliant with the FAA, Federal Arbitration Act. That Act is for maritime issues. Consumer arbitrations are to be compliant with the UCC, universal commercial code. Lest we forget, arbitrations are to be conducted by a neutral 3rd party. The SRO that admittedly conducts almost 99% of the Wall Street-Main Street disputes is a business league that Wall Street pays dues to. Accepting dues from Wall Street, disqualifies the SRO from accepting Main Street complaints.

Amazing how no one has copped to that before now.

Amazing how no one has talked about Madoff and his crimes, pre-2009. Not the US Attorneys that Congress said has oversight of Wall Street crimes. Least of all the SRO, FINRA, that has oversight of Madoff. Hmmm, scratch that. Make that a maybe. By holding the corporate persona of both a Brokerage and Investment Advisor, firms were able to pull complaints in to the SRO DRS, with the client being none the wise.

Dont even get started on the suckabees that feed off investor pain, the lawyers. Amazing how books are written by former US attorneys, city defenders etc that state that they can argue SRO cases in states they are not licensed in. Cant complain. They either threaten to sue the client already traumatized by the Wall Street insider and by the SRO process. The states are of no help. The state Bars dont have their act together on this one either. Random poll to pull- ask how many ever even heard of the SRO holding DRS in their city. AND then ask what happens if that foreign stated lawyer is reported to that Bar of the City the DRS was held in.

Nothing happens. That Bar will tell the person that local Bar does not have oversight over lawyers not licensed by them EVEN if that foreign state lawyer is technically practicing law without a license, in that local city. Dare not tell that foreign lawyer's Bar association in that discretion of what is confidential, protecting the complainant, changes depending upon who does phone intake and who does the letter intake. The complained about lawyer then, can/will, make a call to someone who makes a call, cagey to keep contact distant and not in writing. There is always a paper trail that can be built. But why would a client complain, even in the case of the customer whose representing counsel cashed the DRS refund check for an arbitration or mediation that may have settled.

The judge themselves admit to being overwhelmed and under educated as to the specificities of documents put before them. Judges look at case law and case precedence. Unfortunately, this a a bugaboo in the realm of Wall Street v Main Street. There is Federal law case precedence of cases like Madoff who turned himself in. Federal decisions are Counts for each crime committed. This Federal application may not necessarily have the local law component and for the time period in question another problem for law enforcement looking to do what they do best, protect the beats they walk from the Beasts Of Wall Street that prey.

So below it is shown that Bernard Madoff told the truth, that "THEY KNEW." "They" did. 50 years ago "THEY KNEW" that Madoff was selling no product. But Congress wrote the rules that led Madoff continue to rob investment clients for 5+ decades along with the rules that put Eric Garner behind bars 11 times.

What to do? Well, the law does accommodate for that on local, state and Federal platforms- accessory to crimes, before, during and after the fact. Judges, lawyers, regulators and SROs are not above the law, a gift to maybe every trusting investment client led in to a FINRA forum that worked out badly for the investor. Congress wrote the law that says the SRO is advocating in issues of Broker and Brokerage. Broker and Brokerage. Broker and Brokerage.

The Investment Act of 1935 is very clear 'what to do' when the rules Congress wrote for the SEC, Securities and Exchange Commission, to follow are violated. Madoff was to be reported to the US Attorneys FIFTY YEARS AGO. No one told the US Attorneys. No understanding why Madoff was not to be reported to local police. Ahhh, yes. Corrected, someone did tell the US Attorneys. Madoff did, himself. A few months after the SRO that the SEC appointed sanctioned Madoff for $25,000.

The SRO, Self Regulatory organization came intervened to keep the investment client complaints away from law enforcement, bringing the complaint Sanctions against Madoff's firm, not against Bernie and Peter, who owned the firm, as screengrabbed below. No need to report a complaint if the cops didn't press charges. No charges to press if no one signs a complaint, having been deterred to FINRA Dispute Resolution where confidentiality agreements are signed when a complaint is brought in and expungement agreements are signed if a client wants to collect an award if an award is determined.

The SRO wrote, "... you seem to think that FINRA’s By-Law, Article VI, Section 3, exempts you from any legal obligation to pay the arbitration award at issue because it contain an exception for “valid basis for non-payment.” The By-Law in question permits FINRA to suspend the licenses of firms and associated persons who fail to pay an arbitration award, unless they present a valid reason for not paying the award. The By-Law does not apply to you because you are not a firm or associated person subject to FINRA’s regulatory jurisdiction. You do not hold a securities license that FINRA could suspend."

Dispute resolutions are supposed to be neutral with the law applied equally. With all of the speculation over the years, by investment clients, there is no more quesswork. The SRO arbitrations and mediations are not just. Decisions rendered by the SRO should be repealed, no less, than as far back as 2007 when it underwent its name change from NYSE & NASD to FINRA. Congress let this fraud happen with rules Congress wrote, rewrote time and again.

Eric Garner was not given a chance to give a "valid reason." Garner was jailed, 11 times, over. President Obama's commutants were incarcerated.

THE LIST OF PRESIDENT OBAMA’s COMMUTATIONS

&

A PARTIAL LIST OF FINRA CRIMINALS THAT CONGRESS’ LAWS KEPT OUT OF JAIL

1. Jerry Allen Bailey – Charlotte, NC

Offense: Conspiracy to violate narcotics laws (crack)

Sentenced: (Apr. 2, 1996) 360 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (April 1992) [ Litwin Securities, Inc. (Miami Beach, Florida) and Harold A. Litwin (Registered Principal, Miami Beach, Florida) were fined $10,000, jointly and severally. The firm also was prohibited from effecting principal transactions of any nature for one year, and Litwin was suspended from association with any NASD member in any principal capacity for six months and ordered to requalify by exam in any principal capacity. The SEC affirmed that sanctions following appeal of a January 1995 NBCC decision. The sanctions were based on findings that the firm, acting through Litwin, violated its restriction agreement with the NASD by executing certain securities transactions as principal without authorization ]

2. Shauna Barry-Scott – Youngstown, OH

Offense: Possession with intent to distribute cocaine base

Sentence: (Oct. 18, 2005) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (October 2005) [Thomas Michael Aretz (CRD #1083897, Registered Representative Destin, Florida) submitted a Letter of Acceptance, Waiver and Consent in which he was fined $5,000 and suspended from association with any NASD member in any capacity for 60 days. Without admitting or denying the allegations, Aretz consented to the described sanctions and to the entry of findings that he borrowed $25,000 from a public customer in contravention of the firm’s written procedures. The findings stated that Aretz repaid the loan with interest, but only after the customer complained to NASD and his firm. Aretz’s suspension began September 12, 2005, and will conclude at the close of business November 10, 2005. (NASD Case #2005001180902) ]

3. Larry Darnell Belcher – Martinsville, VA

Offense: Possession with intent to distribute cocaine; possession with intent to distribute marijuana Sentence: (Dec. 15, 1997) Life imprisonment; 10 years’ supervised release

[ FINRA ] (December 1997) [Ronald Howard Tjarks (Registered Representative, Hastings, Nebraska) was fined $340,000 and barred from association with any NASD member in any capacity. The sanctions were based on findings that Tjarks affixed a customer’s signature on annuity withdrawal forms and withdrawal checks totaling $94,000 without the knowledge or consent of the customer. In addition, Tjarks deposited withdrawal checks totaling $54,000 into his personal bank account and converted the funds to his own use and benefit without the knowledge or consent of the customers. Tjarks also failed to respond to NASD requests for information.

4. John L. Houston Brower – Carthage, NC

Offense: Distributed cocaine base (“crack”)

Sentence: (June 22, 2002) Life imprisonment; 10 years’ supervised release

[ FINRA ] (June 2002) [Carla Joy Halverson (CRD #859074, Registered Representative, Littleton, Colorado) submitted an Offer of Settlement in which she was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Halverson consented to the described sanction and to the entry of findings that she engaged in unauthorized transactions in the accounts of public customers without their prior authorization. (NASD Case #C3A020007) ]

5. Nathaniel Brown – Orange Park, FL Offense: Conspiracy to distribute cocaine (more than five kilograms) and cocaine base (more than 50 grams); distribution of cocaine base (two counts) Sentence: (Aug. 1, 2002) Life imprisonment; 10 years’ supervised release

[ FINRA ] (August 2002) [Arthur Kenny Bryant (CRD #1827620, Registered Representative, Edmonds, Washington) was barred from association with any NASD member in any capacity. The sanction was based on findings that Bryant obtained a $4,000 check drawn on a public customer’s account at his member firm, altered the check to make himself the payee, deposited the check in the net amount of $3,900 into his personal credit union savings account, and later withdrew the funds for his own purposes, thereby converting the funds to his own use.(NASD Case #C3B020002) ]

6. Norman O’Neal Brown – Hyattsville, MD

Offense: Distribute quantity of mixture or substance containing a detectable amount cocaine base (crack), aiding and abetting (five counts); possess with intent distribute quantity of mixture or substance containing detectable amount of cocaine base (crack), aiding and abetting

Sentence: (Jan. 15, 1993) Life imprisonment; 10 years’ supervised release

[ FINRA ] (1993) [ FINRA does not publish online 1993 Disciplinary Actions ]

7. Joseph Burgos – Chicago, IL

Offense: Distribution of cocaine; use of a communication facility in the commission of a felony

Sentence: (Sept. 2, 1993) 360 months’ imprisonment; eight years’ supervised release; $200,000 fine

[ FINRA ] (1993) [ FINRA does not publish online 1993 Disciplinary Actions ]

8. Clarance Callies – San Antonio, TX

Offense: Conspiracy to distribute in excess of 50 grams of a mixture or substance containing a detectable amount of cocaine base (“crack cocaine”); possession with intent to distribute in excess of 50 grams of a mixture or substance containing a detectable amount of cocaine base (“crack cocaine”) Sentence: (Mar. 25, 2002) 240 months imprisonment; 8 years’ supervised release

[ FINRA ] (March 2002) [John Perez (CRD #1093871, Registered Representative, Alhambra, California) was barred from association with any NASD member in any capacity and required to pay $5,000 in restitution to a public customer. The sanctions were based on findings that Perez received $5,000 from public customers to be invested and, rather than make the investment as instructed, he converted the funds for his own use and benefit. In addition, Perez failed to respond to NASD requests for information. (NASD Case #C07010067) ]

9. Anthony Leon Carroll – Tampa, FL

Offense: Possession with intent to distribute cocaine base (Middle District of Florida)

Sentence: (Sept. 3, 1999) 262 months’ imprisonment; 5 years’ supervised release

[ FINRA ] (September 1999) [Marlene Marcello McKenna (CRD #832452, Registered Principal, Providence, Rhode Island) submitted a Letter of Acceptance, Waiver, and Consent pursuant to which she was fined $450,000, barred from association with any NASD member in any capacity, and ordered to pay $86,710, plus interest, in restitution to public customers. Without admitting or denying the allegations, McKenna consented to the described sanctions and to the entry of findings that she converted and misappropriated at least $86,710 in cash proceeds from variable life insurance policies of public customers for her own use and benefit. (NASD Case #C11990029) ]

10. Juan Diego Castro – Laredo, TX

Offense: Possession with intent to distribute a quantity in excess of five kilograms of cocaine (Southern District of Texas)

Sentence: (Feb. 1, 2002) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (February 2002) [Michael Earl Hill (CRD #2186074, Registered Principal, Plano, Texas) submitted a Letter of Acceptance, Waiver, and Consent in which he was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Hill consented to the described sanction and to the entry of findings that he received $2.6 million from public customers based on representations that he was going to purchase certificates of deposit on their behalf. Instead, Hill used these funds for his personal benefit. (NASD Case #C06010048) ]

11. Joe Louis Champion – Houston, TX

Offense: Conspiracy to possess with intent to distribute 376.9 grams of cocaine base (crack); aiding and abetting the possession with intent to distribute 376.9 grams of cocaine base (crack) (Southern District of Texas)

Sentence: (June 19, 1997) Life imprisonment; 10 years’ supervised release; $4,000 fine

[ FINRA ] (June 1997) [Individuals Barred Or Suspended Elliot Krausz Adler (Registered Representative, San Francisco, California) was fined $25,000 and barred from association with any NASD member in any capacity. The sanctions were based on findings that Adler received funds totaling $1,350 from a public customer for the purchase of securities and failed to use the proceeds to purchase securities. Adler also failed to respond to NASD requests for information. ]

12. Cedric Culpepper – Orlando, FL

Offense: Possession with intent to distribute cocaine base; possession with intent to distribute five grams or more of cocaine base

Sentence: (Nov. 15, 2004) 188 months’ imprisonment; 4 years’ supervised release

[ FINRA ] (November 2004) [John David Buglisi (CRD #2977744, Registered Representative, Lido Beach, New York) submitted an Offer of Settlement in which he was fined $20,000 and suspended from association with any NASD member in any capacity for 45 days. Without admitting or denying the allegations, Buglisi consented to the described sanctions and to the entry of findings that he purchased and sold shares of stock and call options in public customer accounts without the customers’ knowledge, consent, or authorization. Buglisi’s suspension began November 1, 2004, and will conclude at the close of business December 15, 2004. (NASD Case #CLI040001)]

13. Walter R. Dennie – Gary, IN

Offense: Conspiracy to distribute cocaine (two counts)

Sentence: (Apr. 25, 2002) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (April 2002) [Katarzyna Joanna Jeglinska (CRD #2475845, Registered Representative, Brooklyn, New York) submitted a Letter of Acceptance, Waiver, and Consent in which she was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Jeglinska consented to the described sanction and to the entry of findings that she converted cash in excess of $50,000 from the account of public customers maintained at her member firm for her own use and benefit without the customers’ prior knowledge, authorization, or consent. (NASD Case #C10020022) ]

14. Steven D. Donovan – Oak Creek, WI

Offense: Conspiracy to possess with intent to distribute cocaine; interstate travel to promote distribution of cocaine; possession with intent to distribute cocaine (Eastern District of Wisconsin)

Sentence: (Oct. 16, 1992) Life imprisonment; 10 years’ supervised release

[ FINRA ] (October 1992) [Phung M. Le (CRD #3274440, Registered Representative, Springfield, Massachusetts) was barred from association with any NASD member in any capacity. The sanction was based on findings that Le forged public customers’ signatures on traditional life insurance death benefit checks and deposited the checks into bank accounts for his own use and benefit. (NASD Case #C11020011) ]

15. Romain Dukes – Chicago, IL

Offense: Conspiracy to distribute cocaine base, “crack”; distribution of cocaine base, “crack” (two counts) (Southern District of Iowa)

Sentence: (Oct. 1, 1997) Life imprisonment; 10 years’ supervised release

[ FINRA ] (October 1992) [Robert W. Campbell, Jr. (Registered Representative, Tucker, Georgia) was fined $5,000, suspended from association with any NASD member in any capacity for six months, and ordered to requalify by exam as an investment company and variable contracts products representative. The sanctions were based on findings that Campbell signed the name of a public customer to an investor disclosure form without the customer’s knowledge or authorization. ]

16. Tony Lynn Hollis – Knoxville, TN

Offense: Possession with intent to distribute 26.5 grams of cocaine base

Sentence: (June 8, 2001) 262 months’ imprisonment; eight years’ supervised release

[ FINRA ] (June 2001) [Petra Moreno (CRD #1738689, Registered Representative, El Paso, Texas) was barred from association with any NASD member in any capacity. The sanction was based on findings that Moreno received checks totaling $427.46 representing payments for a life insurance policy the customer purchased, cashed the checks, and used the funds for her own use and benefit without the authorization, knowledge, or consent of the customer. Moreno also failed to respond to NASD requests for information. (NASD Case #C06000032) ]

17. Alex William Jackson – Mineral, VA

Offense: Conspiracy to distribute cocaine base

Sentence: (Dec. 22, 1999); amended to 240 months’ imprisonment (June 25, 2008) 262 months’ imprisonment; 60 months’ supervised release

[ FINRA ] (December 1999) [Scott Patrick Baumgarte (CRD #2912856, Registered Representative, Ellenville, New York) was fined $25,000 and barred from association with any NASD member in any capacity. The sanctions were based on findings that Baumgarte submitted fictitious applications for traditional life insurance policies to his member firm. (NASD Case #C11990026) ]

18. Jackie Johnson – Townsend, DE

Offense: Possession with the intent to distribute more than 50 grams of a cocaine base

Sentence: (Jan. 30, 2007) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (January 2007) [Jo Anne Jean Goulet (CRD #4768440, Associated Person, Ludlow, Massachusetts) submitted a Letter of Acceptance, Waiver and Consent in which she was barred from association with any NASD member in any capacity. Without admitting or denying the findings, Goulet consented to the described sanction and to the entry of findings that she withdrew a total of $116,000 from a public customer’s fixed annuity by systematically withdrawing amounts under $10,000 without the customer’s knowledge, authorization or consent. The findings stated that Goulet deposited the funds into her personal bank account, thereby converting the funds for her own use and benefit. The findings also stated that, as a result of the unauthorized liquidations, the customer incurred $6,500 in surrender fees and suffered adverse tax consequences. (NASD Case #2006004750801) ]

19. Jerome Wayne Johnson – Fort White, FL

Offense: 1. Cultivation of marijuana plants; 2. Conspiracy to manufacture, distribute, and possess with intent to distribute more than 1,000 marijuana plants

Sentence: (June 25, 2003)1. 60 months’ imprisonment, 5 years’ supervised release; (May 27, 2004) 20 years’ imprisonment, concurrent to sentence imposed above, 10 years’ supervised release

[ FINRA ] (June 2003) [Anthony Lucas Debenedictis (CRD #2326689, Registered Representative, White Plains, New York) submitted a Letterof Acceptance, Waiver, and Consent in which he was fined $5,000, suspended from association with any NASD member in any capacity for 30 days, and ordered to pay disgorgement of $381.43, plus interest, in unjust profits in partial restitution to public customers. Without admitting or denying the allegations, Debenedictis consented to the described sanctions and to the entry of findings that he effected transactions in the joint trust account of public customers without their prior knowledge, authorization, or consent. Debenedictis’ suspension began May 19, 2003, and will conclude at the close of business June 17, 2003. (NASD Case #C10030028) ]

20. Willie C. Johnson – Steele, MO

Offense: The defendant did knowingly conspire to distribute and possess with the intent to distribute cocaine base; the defendant did knowingly distribute cocaine base; the defendant did knowingly possess with the intent to distribute cocaine base Sentence: (Feb. 18, 2005); amended to 168 months’ imprisonment (Feb. 12, 2015) 360 months’ imprisonment; five years’ supervised release

[ FINRA ] (February 2005) [David Anthony DeBlasio (CRD #2304878, Registered Representative, Newark, Delaware) submitted a Letter of Acceptance, Waiver, and Consent in which he was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, DeBlasio consented to the described sanction and to the entry of findings that he converted at least $80,000 from bank customers through a variety of methods, including using “debt slips” to effect the withdrawal of funds from customers’ bank accounts to make payments to other bank customers or to enrich himself. (NASD Case #C9A040062) ]

21. Mark Anthony Jones – Boynton Beach, FL

Offense: Distribution of cocaine base

Sentence: (July 28, 1999) Life imprisonment; 10 years’ supervised release

[ FINRA ] (July 1999) [Philip Sidney Gassman (CRD #1569242, Registered Representative, Miami, Florida) submitted a Letter of Acceptance, Waiver, and Consent pursuant to which he was censured, fined $5,000, and suspended from association with any NASD member in any capacity for 10 business days. Without admitting or denying the allegations, Gassman consented to the described sanctions and to the entry of findings that he exercised discretionary power in a public customer’s account without obtaining prior written authorization from the customer, and without having the account accepted as a discretionary account by his member firm. ( NASD Case #C07990028) ]

22. Roy Larry Lee – St. Petersburg, FL

Offense: Conspiracy to possess with intent to distribute cocaine base (enhanced penalty); distribution of 50 grams or more of cocaine base (two counts) Sentence: (May 3, 1990) Life imprisonment; 10 years’ supervised release

[ FINRA ] (1990) [ FINRA does not publish 1990 Disciplinary Actions ]

23. Kenneth Lorenzo Lewis – Charlottesville, VA

Offense: Conspiracy to distribute cocaine base (Western District of Virginia)

Sentence: (Nov. 17, 2000) 262 months’ imprisonment; five years’ supervised release

[ FINRA ] (November 2000) [Leon Wilman Brooks, Sr. (CRD #1064259, Registered Representative, New Orleans, Louisiana) was barred from association with any NASD member in any capacity. The sanction was based on findings that Brooks received $2,209 from public customers as payment for insurance premiums and converted $1,564 of the funds to his own use and benefit without the customers’ knowledge or consent. The findings also stated that Brooks failed to respond to NASD requests for

information. (NASD Case #C05000010)

24. Douglas M. Lindsay, II – Newberry, SC

Offense: Conspiracy to possess with intent to distribute and distribution of cocaine and cocaine base

Sentence: (Dec. 20, 1996); amended to 293 months’ imprisonment (Mar. 4, 2015) Life imprisonment; five years’ supervised release

[ FINRA ] (December 1998) [Maureen Galligan (Registered Representative, San Diego, California), Gerald Seroy (Registered Representative, Basking Ridge, New Jersey), and Jeffrey K. Trilling (Registered Representative, Rockville, Maryland) submitted Offers of Settlement pursuant to which Galligan was fined $6,567.15 and suspended from recommending any transactions in penny stocks for one year. Seroy was fined $2,552.94 and suspended from recommending any transactions in penny stocks for one year, and Trilling was fined $2,812 and suspended from recommending any transactions in penny stocks for one year. Without admitting or denying the allegations, the respondents consented to the described sanctions and to the entry of findings that Galligan, Seroy, and Trilling effected $54,480 in penny stock transactions for public customers in contravention of Section 15(g) of the Securities Exchange Act of 1934. ]

25. Kevin Matthews – James Island, SC

Offense: Conspiracy to distribute and possess with intent to distribute cocaine base

Sentence: (Feb. 11, 2004) 232 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (February 2004) [Julio Enrique DeJesus (CRD #4086955, Registered Representative, Yonkers, New York) submitted a Letter of Acceptance, Waiver, and Consent in which he was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, DeJesus consented to the described sanction and to the entry of findings that he falsified bank withdrawal slips and misused $15,000 by initiating unauthorized withdrawals from bank client accounts. (NASD Case #C11030043) ]

26. Marlon McNealy – St. Petersburg, FL

Offense: Conspiracy to commit racketeering (two counts); conspiracy to distribute cocaine base; knowingly and intentionally distributing 50 grams or more of cocaine base (three counts)

Sentence: (Aug. 18, 1993) Life imprisonment; 10 years’ supervised release

[ FINRA ] (August 1993) [ FINRA does not publish 1993 Disciplinary Actions ]

27. Brian Nickles – New Orleans, LA

Offense: Distribution of more than 50 grams of cocaine base (two counts)

Sentence: (Apr. 28, 2004) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (April 2004) [Lawrence Michael Schwartz (CRD #1818360, Registered Representative, Huntington, New York) submitted a Letter of Acceptance, Waiver, and Consent in which he was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Schwartz consented to the described sanction and to the entry of findings that he forged checks totaling $713,000 from the bank account of a customer of a bank affiliate of Schwartz’ member firm by completing and signing the customer’s name to the checks. The findings also stated that Schwartz failed to respond to an NASD request to provide a written statement. (NASD Case #C10040014) ]

28. Jermaine Lee Osborne – Roanoke, VA

Offense: Conspiracy to possess with intent to distribute at least 50 grams of cocaine base

Sentence: (May 2, 2006) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (May 2006) [Theresa L. Logan (CRD #4614539, Registered Representative, Alvada, Ohio) submitted a Letter of Acceptance, Waiver and Consent in which she was barred from association with any NASD member in any capacity. Without admitting or denying the findings, Logan consented to the described sanction and to the entry of findings that she forged public customers’ signatures on documents related to insurance applications and premiums, and failed to respond to NASD requests for information. (NASD Case #E8A20040943-01) ]

29. Marcus H. Richards – Miami, FL

Offense: Conspiracy to distribute and to possess with intent to distribute more than five kilograms of cocaine and more than 50 grams of cocaine base

Sentence: (June 13, 2005) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (June 2005) [Shawn Allen Linneborn (CRD #3023329, Registered Representative, Depew, New York) submitted a Letter of Acceptance, Waiver, and Consent in which he was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Linneborn consented to the described sanction and to the entry of findings that he converted $14,000, and attempted to convert an additional $17,409.97, of a public customer’s funds. The findings also stated that Linneborn failed to respond to NASD requests for information. (NASD Case #C9B050024) ]

30. Patrick Roberts – Detroit, MI

Offense: Conspiracy to possess with intent to distribute and to distribute controlled substances

Sentence: (July 8, 1999) Life imprisonment; 10 years’ supervised release

[ FINRA ] (July 1999) [ Luanne Christine Lembo (CRD #2469080, Registered Representative, Orlando, Florida) submitted a Letter of Acceptance, Waiver, and Consent pursuant to which she was censured, fin e d $2,500, and suspended from association with any NASD member in any capacity for 60 days. Without admitting or denying the allegations, Lembo consented to the described sanctions and to the entry of fin d i n g s that she signed the name of a public customer to a letter requesting the wire transfer of funds, without the customer’s knowledge or consent. (NASD Case #C9B990001) ]

31. Bryant Keith Shelton – Kissimmee, FL

Offense: Distribution of cocaine base (Middle District of Florida)

Sentence: (Apr. 1, 2003) 188 months’ imprisonment; five years’ supervised release

[ FINRA ] (April 2003) [David Edward Hausch (CRD #2353438, Registered Principal, East Northport, New York) submitted an Offer of Settlement in which he was suspended from association with any NASD member in any capacity for two years. Without admitting or denying the allegations, Hausch consented to the described sanction and to the entry of findings that he failed to testify truthfully, accurately, non-deceptively, and/or completely during an NASD on-the-record interview. Hausch’s suspension began April 7, 2003, and will conclude at the close of business April 6, 2005. (NASD Case #C10990158) ]

32. Ezekiel Simpson – St. Louis, MO

Offense: Possession with intent to distribute cocaine base (Eastern District of Missouri)

Sentence: (Feb. 3, 2005) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (February 2005) [ Eva Yee May Sung (CRD #4567379, Registered Representative, Irvine, California) submitted a Letter of Acceptance, Waiver, and Consent in which she was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Sung consented to the described sanction and to the entry of findings that she forged the signatures of public customers and a branch manager on forms authorizing Sung to become the new representative of certain “orphaned” brokerage accounts. (NASD Case #C02040055)]

33. Katrina Stuckey Smith – Montrose, GA

Offense: Conspiracy to possess with intent to distribute cocaine and cocaine base

Sentence: (July 20, 2000); amended to 240 months’ imprisonment (Apr. 2, 2008). 292 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (July 2000) [Brian Lamont Dale (CRD #2521526, Registered Representative, South Holland, Illinois) was barred from association with any NASD member in any capacity, and ordered to repay his member firm $2,798.56 in insurance commissions. The sanctions were based on findings that Dale used another agent’s name and code number to submit insurance applications in order to wrongfully receive commissions totaling $2,798.56 from the firm. Dale also failed to respond to NASD requests for information. (NASD Case #C8A990043)]

34. James Marion Stockton – Martinsville, VA

Offense: Possession with intent to distribute more than five grams of cocaine base; possession of a firearm during and in relation to a drug trafficking offense; possession of a firearm by a convicted felon; possession with intent to distribute cocaine base

Sentence: (May 27, 2003) 420 months’ imprisonment; eight years’ supervised release

[ FINRA ] (May 2003) [Ali Keita (CRD #4349045, Associated Person, East Rutherford, New Jersey) submitted a Letter of Acceptance, Waiver, and Consent in which he was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Keita consented to the described sanction and to the entry of findings that, without the permission or authority from his member firm, he deposited a $7,937.77 check, payable to his member firm, into his personal bank account and attempted to convert the proceeds for his personal use. The findings also stated that Keita failed to respond to NASD requests to appear for an on-the-record interview. (NASD Case #C9B030016) ]

35. Bart Stover – Ashland, OH

Offense: Conspiracy to possess with the intent to distribute marijuana and cocaine; use of a communication facility to facilitate the commission of drug trafficking offense, aiding and abetting

Sentence: (Apr. 12, 2005) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (April 2005) [Mark Francis Mizenko (CRD #1812411, Registered Representative, Kent, Ohio) was barred from association with any NASD member in any capacity. The sanction was based on findings that Mizenko committed forgery by tracing a corporate officer’s name onto a document without his knowledge or permission and by using his notary seal to affix a purported corporate seal onto a document. This decision has been appealed to the SEC, and the sanction is not in effect pending consideration of the appeal. (NASD Case #C8B030012) ]

36. Robert Earl Thomas, Jr. – Houston, TX

Offense: Possession with intent to distribute a controlled substance

Sentence: (June 29, 1999) 262 months’ imprisonment; five years’ supervised release

[ FINRA ] (June 1999) [Oscar Conrad Dotson (CRD #2585430, Registered Representative, Providence, Rhode Island) was named as a respondent in an NASD complaint alleging that he received a check in the amount of $556.70 from a public customer in order to pay the premium to reinstate her husband’s insurance policy, failed to apply the $556.70 to the insurance policy as intended by the customer, and instead, improperly converted the funds for his own use and benefit. The complaint also alleges that Dotson failed to respond to NASD requests for information. (NASD Case #C11990020) ]

37. Bruce Todd – Atlanta, GA

Offense: Distribution of at least 50 grams of crack cocaine

Sentence: (Mar. 3, 2003) 262 months’ imprisonment; five years’ supervised release

[ FINRA ] (March 2003) [James William Jonen (CRD #704727, Registered Representative, Hoffman Estates, Illinois) submitted a Letter of Acceptance, Waiver, and Consent in which he was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Jonen consented to the described sanction and to the entry of findings that, without having authority, he received a check made payable to his member firm, endorsed the check to himself, and deposited the check into his personal investment account. The findings also stated that Jonen endorsed and deposited misdirected commission checks totaling $20,559.99 into his personal investment account. (NASD Case #C8A030007) ]

38. Jeffery Jerome Toler – Pensacola, FL

Offense: Conspiracy to possess with intent to distribute cocaine and cocaine base

Sentence: (June 13, 1996) Life imprisonment; 10 years’ supervised release

[ FINRA ] (June 1996) [Steven J. Sogard (Registered Principal, Phoenix, Arizona) submitted an Offer of Settlement pursuant to which he was fined $15,000 and ordered to be subject to the requirement that should he wish to offer to sell any qualifying security, such offer to sell or sale must be made on the condition that all investor funds are deposited into and remain in an escrow account established and maintained in conformity with SEC Rule 15c2-4 until the earlier of the effective date of the issuer's registration as a broker/dealer or the date upon which the offering documents provide for the return of investor funds if broker/dealer registration has not occurred. Without admitting or denying the allegations, Sogard consented to the described sanctions and to the entry of findings that he offered and sold securities pursuant to three offering memoranda that contained material misrepresentations and omissions. ]

39. Donald Vanderhorst – Charleston, SC

Offense: Conspiracy to possess with intent to distribute and distribution of five kilograms or more of cocaine and 50 grams or more of cocaine base Sentence: (Mar. 15, 2006) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (March 2006) [Michael James France (CRD #3176408, Registered Representative, Cherry Hill, New Jersey) submitted a Letter of Acceptance, Waiver and Consent in which he was fined $10,000 and suspended from association with any NASD member in any capacity for 10 business days. The fine must be paid before France reassociates with any NASD member following the suspension, or before he requests relief from any statutory disqualification. Without admitting or denying the allegations, France consented to the described sanctions and to the entry of findings that he signed a Life Insurance Company Fixed Annuity Application as having witnessed a public customer signing the application when in fact, he did not witness it. France’s suspension began on March 6, 2006, and will conclude at the close of business on March 17, 2006. (NASD Case #2005000090701) ]

40. James Nathan Walton – Thibodeaux, LA

Offense: Possession with intent to distribute cocaine base

Sentence: (Sept. 16, 2004) 240 months’ imprisonment; 10 years’ supervised release

[ FINRA ] (September 2004) [John Alan Briscoe (CRD #3168614, Registered Representative, Columbia, Georgia) submitted an Offer of Settlement in which he was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Briscoe consented to the described sanction and to the entry of findings that he falsified firm records and misappropriated his firm’s funds in that he submitted false contribution requests for retirement plan participants to his firm, resulting in the payment by the firm of approximately $71,000 in commissions to which Briscoe was not entitled. The findings also stated that Briscoe failed to respond to NASD requests for information. ]

[ FINRA ] (September 2004) (NASD Case #C07040037) Diane Kathryn Byrd (CRD #4078944, Registered Representative, Rapid City, South Dakota) submitted a Letter of Acceptance, Waiver, and Consent in which she was barred from association with any NASD member in any capacity.

Without admitting or denying the allegations, Byrd consented to the described sanction and to the entry of findings that she misused customer funds totaling $74,333.20. (NASD Case #C04040038) ]

41. Telisha Rachette Watkins – Charlotte, NC

Offense: Conspiracy to possess with intent to distribute cocaine and cocaine base

Sentence: (Oct. 25, 2007) 240 months’ imprisonment; eight years’ supervised release

[ FINRA ] (October 2007) [Brandon W. Cade (CRD #5062931, Registered Representative, Chicago,Illinois) Was barred from association with any FINRA Member in any capacity. The sanction was based on findings that Cade withdrew $1,300 from his teller cash drawer at a bank affiliate of his member firm with out permission and used the funds for his own purposes. The findings stated that Cade failed to respond to FINRA requests for information. (FINRA Case #2006006367801)

42. Dunning Wells – Fort Myers, FL

Offense: Unlawful possession of a firearm; distribution of a quantity of cocaine; possession of a firearm during and in relation to a drug trafficking crime

Sentence: (Feb. 20, 1992) 502 months’ imprisonment; six years’ supervised release

[ FINRA ] (1992) [ FINRA does not publish 1992 Disciplinary Actions ]

43. Kimberly A. Westmoreland – Columbus, OH

Offense: Conspiracy to distribute in excess of 50 grams of cocaine base; carrying a firearm in relation to a drug trafficking crime

Sentence: (Jan. 21, 2004) 180 months’ imprisonment; five years’ supervised release

[ FINRA ] (January 2002) [Larry Joseph Bolden (CRD #2073064, Registered Representative, Austin, Texas) was barred from association with any NASD member in any capacity. The sanction was based on findings that Bolden forged the signature of a public customer on letters of authorization to transfer funds to an account he controlled without the customer’s authorization, knowledge, or consent. The findings also stated that Bolden transferred at least $23,466 from the customer’s account to his own account and used the converted funds to his own use and benefit. NASD also found that Bolden failed to respond to NASD requests for information and documents. (NASD Case #C06030010) ]

44. James Rufus Woods – Leasburg, NC

Offense: Possess with intent to distribute cocaine base (“crack”)

Sentence: (Nov. 23, 1998) Life imprisonment; 10 years’ supervised release

[ FINRA ] (November 1998) [Ming Cheng (Registered Representative, Ridgewood, New York) was censured, fined $78,745, and barred from association with any NASD member in any capacity. The sanctions were based on findings that Cheng caused his member firm to issue a check for $749 to him on behalf of an insurance customer, forged the customer’s signature on the check, and converted the funds to his own use and benefit. Cheng also failed to respond to NASD requests for information. ]

45. John M. Wyatt – Las Cruces, NM

Offense: Possession with intent to distribute marijuana (Southern District of Illinois)

Sentence: (Aug. 30, 2004) 262 months’ imprisonment; eight years’ supervised release; $500 fine

[ FINRA ] (August 2004) [Clyde Allen Christensen (CRD #1505051, Registered Representative, Vancouver, Washington) was barred from association with any NASD member in any capacity. The sanction was based on findings that Christensen solicited and accepted payments from public customers totaling $105,000 to be used to purchase securities and, without the customers’ knowledge or consent, Christensen deposited the funds into a bank account and a money market account that he controlled. NASD found that Christensen subsequently returned approximately $20,900 of the funds, but retained the remaining funds and converted them to his own use and benefit. NASD also found that Christensen failed to respond to NASD requests for information. (NASD Case #C3B040006) ]

46. Robert Joe Young – Joppa, AL

Offense: Conspiracy to possess with the intent to distribute a mixture and substance containing methamphetamine; possession with the intent to distribute a mixture and substance containing methamphetamine; use of a firearm during and in furtherance of a drug trafficking crime; possession with the intent to distribute a mixture and substance containing cocaine; carrying a firearm during and in relation to a drug trafficking crime; endeavoring to influence and impede the administration of justice

Sentence: (Dec. 16, 2002) 240 months’ imprisonment; 5 years’ supervised release

[ FINRA ] (December 2002) [Amy Shui (CRD #707519, Registered Representative, Long Branch, New Jersey) submitted a Letter of Acceptance, Waiver, and Consent in which she was barred from association with any NASD member in any capacity. Without admitting or denying the allegations, Shui consented to the described sanction and to the entry of findings that she effected transactions in public customers’ accounts without the customers’ prior knowledge, authorization, or consent. NASD also found that, without the knowledge or approval of her member firm, Shui paid customers $10,000 in exchange for the customers’ agreement not to file an arbitration statement of claim against her. (NASD Case #C9B020080) ]