|

|

|

Distinguished Toastmaster

BUSINESS & BRANDING COACH . LIFE & LEADERSHIP STRATEGIST MOTIVATIONAL SPEAKER SERVING ENTREPRENEURS & MAIN STREET |

_______________________________________________________________________________________________________________________________________

SEC BARRING OF STEVEN A COHEN FOR 2 YRS IS PRIME EXAMPLE OF CONGRESSIONAL FIDUCIARY FAILURE LETTING WALL STREET WALK WHEN MAIN STREET GOES TO JAIL (c) Carrie Devorah :

_______________________________________________________________________________________________________________________________________

SEC BARRING OF STEVEN A COHEN FOR 2 YRS IS PRIME EXAMPLE OF CONGRESSIONAL FIDUCIARY FAILURE LETTING WALL STREET WALK WHEN MAIN STREET GOES TO JAIL (c) Carrie Devorah :

_______________________________________________________________________________________________________________________________________

|

Congress wrote a law that requires the SEC to report crimes to the US Attorneys. The SEC announcing that hedge fund manager Steven A Cohen being prohibited from “supervising funds that manage outside money until 2018” raises question if the SEC complied with laws Congress wrote the Commission to follow.

Main Street goes to jail while Wall Street pays to play and walks. |

Any Main Streeter that was involved in using Secrets to profit would be charged with Accessory, Conspiracy, theft of Intellectual Property, the list goes on and on. That Cohen is barred chills Main Street to see Main Street protection has not improved since Bernard Madoff walked himself in to the US Attorney office, turning himself in for Criminal Behaviour Wall Street knew of since 1963, over 50 years.

Documented (www.centerforcopyrightintegrity.com Search Madoff, Search FINRA)

The SEC does Congress’ bidding to protect investors. Word of Cohen being barred means that Cohen is barred, all the employees are not barred, still working in the industry.

Moreso, Cohen’s ban is solely from supervising funds that manage outside money. Cohen is not banned from participating in other areas of Wall Street that Cohen licenses for. S.A.C. Capital Advisors are Investment Advisors. Investment Advisors are licensed by the SEC if their funds exceed $100 million. Investment Advisors, otherwise are not licensed by the SEC nor allowed to be oversight of the only S.R.O. that the Commission approved, in defiance of Congress' Act ordering multiple S.R.O.s to exist.

The S.R.O. FINRA lists the Cohen's of the Wall Street world as "employees" when that is not always the case. The "employees" as designated on FINRA brokercheck may in fact be independent contractors giving the firm of piece of the client action. FINRA brokercheck allows complaints to be expunged without the required standard of fiduciary of the request presented to a DRS panel and/or court for review. FINRA has no oversight of Investment Advisors, despite giving the unsuspecting investment client the impression FINRA does, complicit communicating that misimpression via lawyers participating in the S.R.O. process. FINRA is limited to disputes between brokers and brokerages.

The SEC is bound by Congress to report matters like Cohen’s to the US Attorneys. The SEC oversight is regulatory, only, not criminal oversight that puts crime participants in jail. The $600 million that Cohen’s subsidiary firm, CR Intrinsic, agreed to pay, March 2013, to settle SEC charges, the $1.2 billion that Cohen’s companies, including, S.A.C. Capital Advisors and CR Intrinsic, paid to resolve criminal charges brought by the U.S. Attorney’s Office for the Southern District of New York, are unspeakable numbers paid to make crimes go away- courtesy not given to Eric Garner, Sandra Bland, Freddie Gray, the almost 200 commutants that President Obama gave lives back to after time in jail, unable to get their lost lives and privacies back, unable to expunge their crimes.

Congress allowing Wall Street to pay almost $2 billion in hush money is shamefully contradicting in a legislature that jumped on the Criminal Justice reform bandwagon started in by Congressman Keith Ellison’s Investor Protection Act, Bill HR 1098.

The almost $2 billion in hush money is split between the SEC and the Federal Reserve. Basically, Peter is paying Political Paul.

A Main Street person participating in a similar such crime is charged as an accessory to the crime. A Wall Street person participating in the crime of using inside information is not only not charged as accessory, the person is given a dateline of when they will go back to work in this role, without being forced to check the box, as this person can continue in business, in the same office, with the same employees, colleagues and customers, as long at this Wall Street'r is licensed in that other Wall Street industry related roles ie. Broker, insurance, etc.

The statement that the SEC will conduct examinations and the Cohen family firms must retain “an independent consultant to conduct periodic reviews of their activities to ensure compliance with securities laws” is balderdash if the unnamed “independent consultant” has worked in and around Wall Street, a small incestuous world where Wall Street’rs have lost sight of the intent of the laws Congress wrote starting back in the 30’s.

Andrew J. Ceresney, Director of the SEC’s Enforcement Division stating “The strong combination of a two-year supervisory bar and additional oversight requirements achieves significant and immediate investor protection and deterrence, while ensuring that the activities of his funds are closely monitored going forward” misleads the public in to thinking the shark tank is safe to step back in to. Cohen’s team is still Cohen’s team.

S.A.C. Capital Advisors LLC is a global investment advisory entity. That few in the news are covering this story is alarming moreso knowing the SEC is not going to notify each and every investor of this firm the owner is barred a shocking only two years for crimes the investors would go to jail for.

The SEC and legislators owe it to investors to be notified, each and every client, current and past and future, by notices on all the firms websites, domestically and internationally, by certified mail, by snail mail and/or priority mail, on each and every page of each and every company and website related to Steven Cohen. After all, a fish stinks from the head down.

The fiduciary here failing investors and Main Street, is Congress, failing to assure the Commission does its job by unsealing the dome of protection that keeps Wall Street crimes reported to law enforcement and Wall Street criminals going to jail.

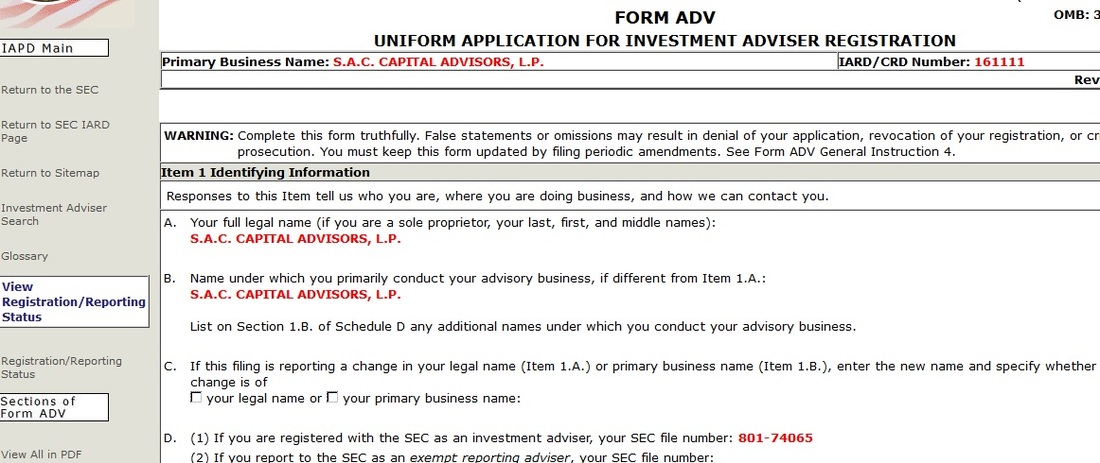

AUTHORs NOTE: Neither FINRA brokercheck nor the SEC have red-flagged the Brokercheck or SEC IAPD of Cohen's companies alerting global consumers of the SEC announcement the 2 year investigation, 2013-2015 conclusion.

Documented (www.centerforcopyrightintegrity.com Search Madoff, Search FINRA)

The SEC does Congress’ bidding to protect investors. Word of Cohen being barred means that Cohen is barred, all the employees are not barred, still working in the industry.

Moreso, Cohen’s ban is solely from supervising funds that manage outside money. Cohen is not banned from participating in other areas of Wall Street that Cohen licenses for. S.A.C. Capital Advisors are Investment Advisors. Investment Advisors are licensed by the SEC if their funds exceed $100 million. Investment Advisors, otherwise are not licensed by the SEC nor allowed to be oversight of the only S.R.O. that the Commission approved, in defiance of Congress' Act ordering multiple S.R.O.s to exist.

The S.R.O. FINRA lists the Cohen's of the Wall Street world as "employees" when that is not always the case. The "employees" as designated on FINRA brokercheck may in fact be independent contractors giving the firm of piece of the client action. FINRA brokercheck allows complaints to be expunged without the required standard of fiduciary of the request presented to a DRS panel and/or court for review. FINRA has no oversight of Investment Advisors, despite giving the unsuspecting investment client the impression FINRA does, complicit communicating that misimpression via lawyers participating in the S.R.O. process. FINRA is limited to disputes between brokers and brokerages.

The SEC is bound by Congress to report matters like Cohen’s to the US Attorneys. The SEC oversight is regulatory, only, not criminal oversight that puts crime participants in jail. The $600 million that Cohen’s subsidiary firm, CR Intrinsic, agreed to pay, March 2013, to settle SEC charges, the $1.2 billion that Cohen’s companies, including, S.A.C. Capital Advisors and CR Intrinsic, paid to resolve criminal charges brought by the U.S. Attorney’s Office for the Southern District of New York, are unspeakable numbers paid to make crimes go away- courtesy not given to Eric Garner, Sandra Bland, Freddie Gray, the almost 200 commutants that President Obama gave lives back to after time in jail, unable to get their lost lives and privacies back, unable to expunge their crimes.

Congress allowing Wall Street to pay almost $2 billion in hush money is shamefully contradicting in a legislature that jumped on the Criminal Justice reform bandwagon started in by Congressman Keith Ellison’s Investor Protection Act, Bill HR 1098.

The almost $2 billion in hush money is split between the SEC and the Federal Reserve. Basically, Peter is paying Political Paul.

A Main Street person participating in a similar such crime is charged as an accessory to the crime. A Wall Street person participating in the crime of using inside information is not only not charged as accessory, the person is given a dateline of when they will go back to work in this role, without being forced to check the box, as this person can continue in business, in the same office, with the same employees, colleagues and customers, as long at this Wall Street'r is licensed in that other Wall Street industry related roles ie. Broker, insurance, etc.

The statement that the SEC will conduct examinations and the Cohen family firms must retain “an independent consultant to conduct periodic reviews of their activities to ensure compliance with securities laws” is balderdash if the unnamed “independent consultant” has worked in and around Wall Street, a small incestuous world where Wall Street’rs have lost sight of the intent of the laws Congress wrote starting back in the 30’s.

Andrew J. Ceresney, Director of the SEC’s Enforcement Division stating “The strong combination of a two-year supervisory bar and additional oversight requirements achieves significant and immediate investor protection and deterrence, while ensuring that the activities of his funds are closely monitored going forward” misleads the public in to thinking the shark tank is safe to step back in to. Cohen’s team is still Cohen’s team.

S.A.C. Capital Advisors LLC is a global investment advisory entity. That few in the news are covering this story is alarming moreso knowing the SEC is not going to notify each and every investor of this firm the owner is barred a shocking only two years for crimes the investors would go to jail for.

The SEC and legislators owe it to investors to be notified, each and every client, current and past and future, by notices on all the firms websites, domestically and internationally, by certified mail, by snail mail and/or priority mail, on each and every page of each and every company and website related to Steven Cohen. After all, a fish stinks from the head down.

The fiduciary here failing investors and Main Street, is Congress, failing to assure the Commission does its job by unsealing the dome of protection that keeps Wall Street crimes reported to law enforcement and Wall Street criminals going to jail.

AUTHORs NOTE: Neither FINRA brokercheck nor the SEC have red-flagged the Brokercheck or SEC IAPD of Cohen's companies alerting global consumers of the SEC announcement the 2 year investigation, 2013-2015 conclusion.